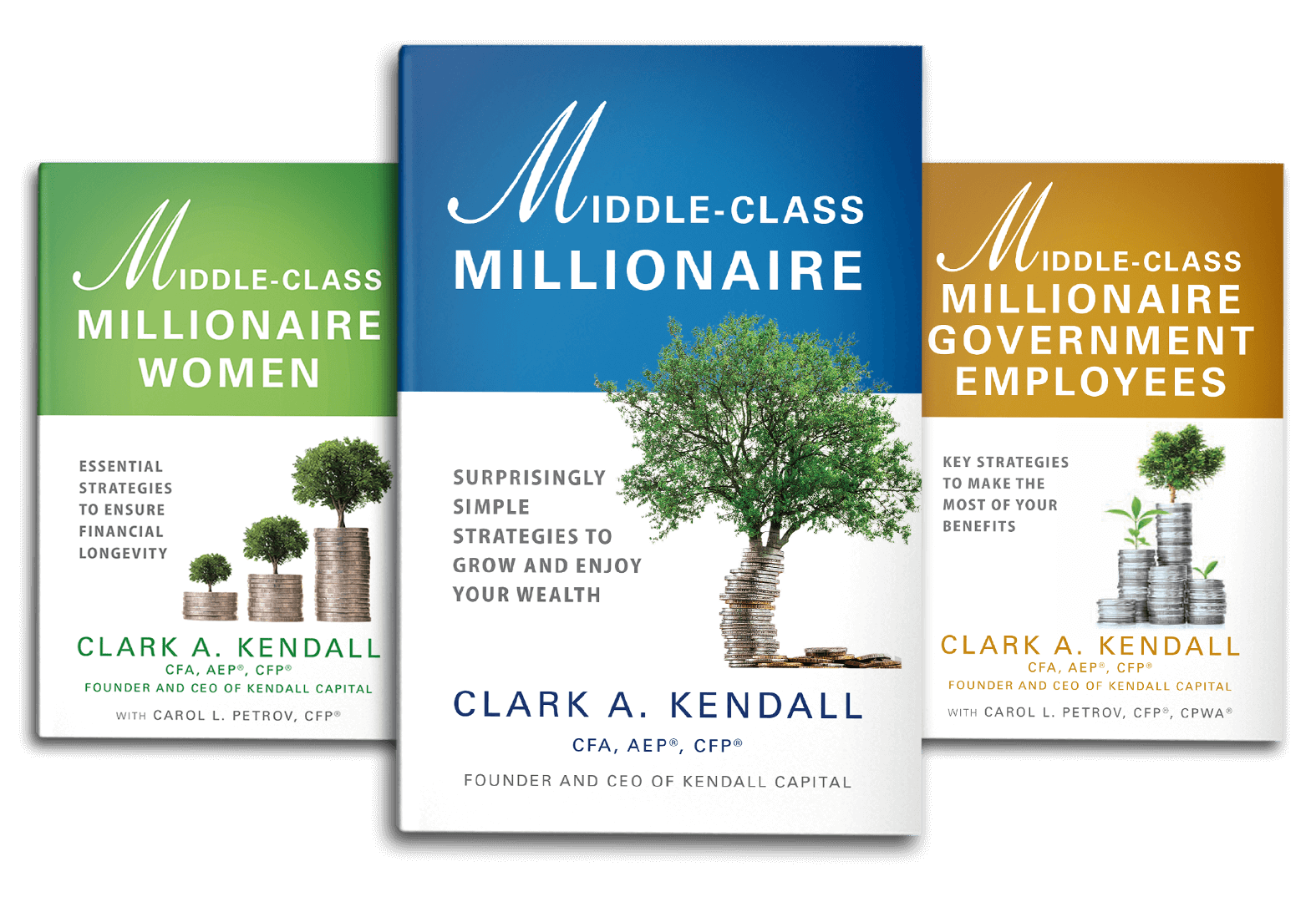

We Call You Middle-Class Millionaires, and We’ve Built Our Firm to Serve You

You’ve amassed wealth – such as retirement accounts or inheritance – but you don’t have the support you need, nor do you feel like you’re getting the personalized attention you deserve from your current advisor. At Kendall Capital, we are committed to providing you with the same personalized, fee-only fiduciary advice enjoyed by ultra-high-net-worth individuals. If you’ve acquired $500,000 or more in investable assets, including retirement accounts, we’d love to work with you.